Iron condor is a delta neutral, high probability options trade. Given that most people’s portfolio is long the market for most of the times, incorporating iron condor in the portfolio can be a good way to add little or even negatively correlated profits.

We can think of an iron condor as (1) short an inner strangle + long a wider strangle, or (2) short a put spread + short a call spread. (1) gives the greeks properties of an iron condor: short vol, short gamma, long theta. (2) gives the directional properties of an iron condor: delta neutral on the tight span, but as underlying moves, iron condor starts to pick up delta that is against the direction of the underlying movement.

Since an iron condor contains 4 legs, as retail traders we need to find stocks/ETFs with good liquidity to reduce bid-ask. Therefore, this backtest will first look at probably the most traded ETF, SPY.

In the first iteration, we are going to follow the VTS Iron Condor strategy with the following rules:

- 45-75 DTX.

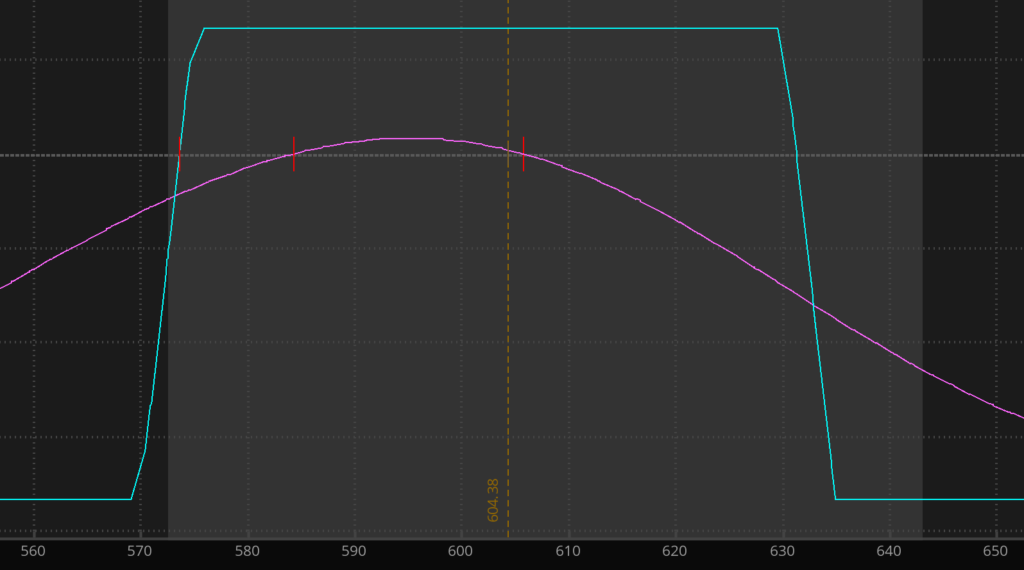

- Short 15 delta strangle and long $5 wider strangle.

- Open a new layer whenever SPY moves more than 4%.

- Allocate 3% of net liquidation value.

and the following assumptions:

- Trade frequency is at most once per day.

- We look at two timestamps, either 10 AM CST, or 1:30 PM CST.

- Bid-ask is 1% of TV (which is normally between $1.1 and $1.3).

- Transaction cost is $0.65/contract, so $2.6 per iron condor.

Some key questions to answer:

- How much does 50% stop-gain and stop-loss help the strategy, both in terms of capital efficiency, and in terms of win rate?

- How many layers should we allow?

- How much does opening new trades only in high-vol environment help the strategy?

- What is the trade frequency and return?