A bad day for the portfolio after FOMC, but still got a double eagle trade in around noon.

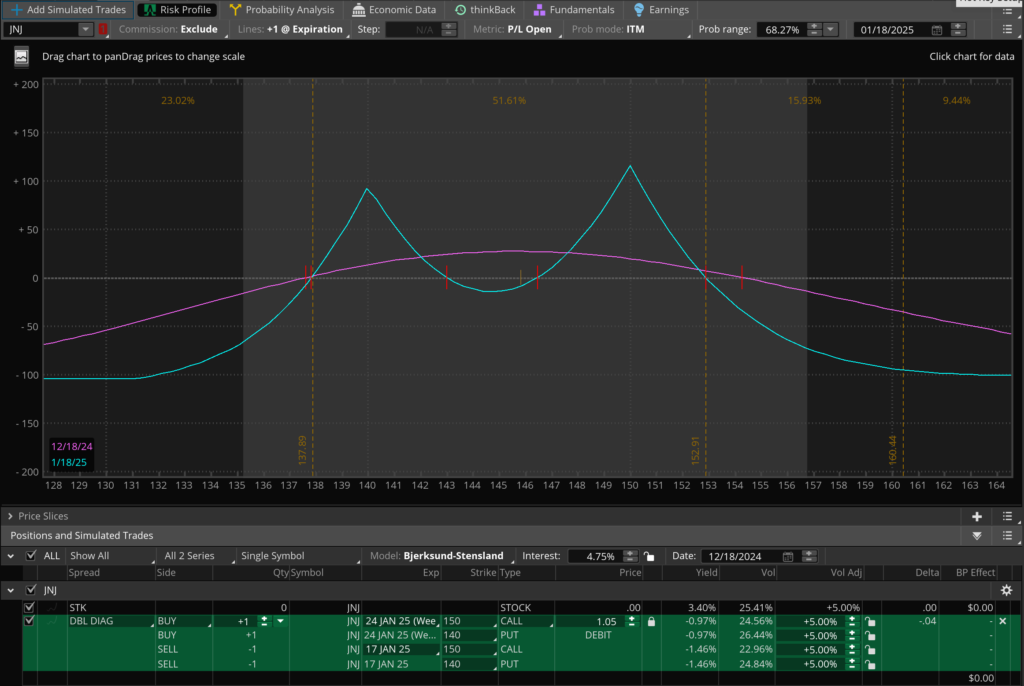

Trade 1. JNJ Double Eagle

Exit

Total PNL (before transaction cost): +21.6%

Update 1/21: closed the rest 2/3 of the positions at two price levels, $1.22 and $1.25.

- Close stats

- Vol: F5.24 @ 34.5%

- Underlying: $148.49

Update 1/17: since the last closing trade, JNJ has rallied away from the put strike. I let the front strangle expire and we will see if JNJ gets a move next week.

Update 1/13: closed 1/3 of the positions at $1.36.

Enter

- Earnings release date: 1/22

- Trade: F5.17/F5.24 140/150 STG SWAP

- ToT stats

- Vol: F5.17 @ 20.5%, F5.24 @ 20.5%

- Underlying: $145.73

- Premium: $1.05

- DPR: 0.72%

- SPR: 6.87%

- Expected IV build: 5%