Last day of 2024! Happy New Year everyone and wish all good trading in 2025. Today we opened 2 Double Eagle trades.

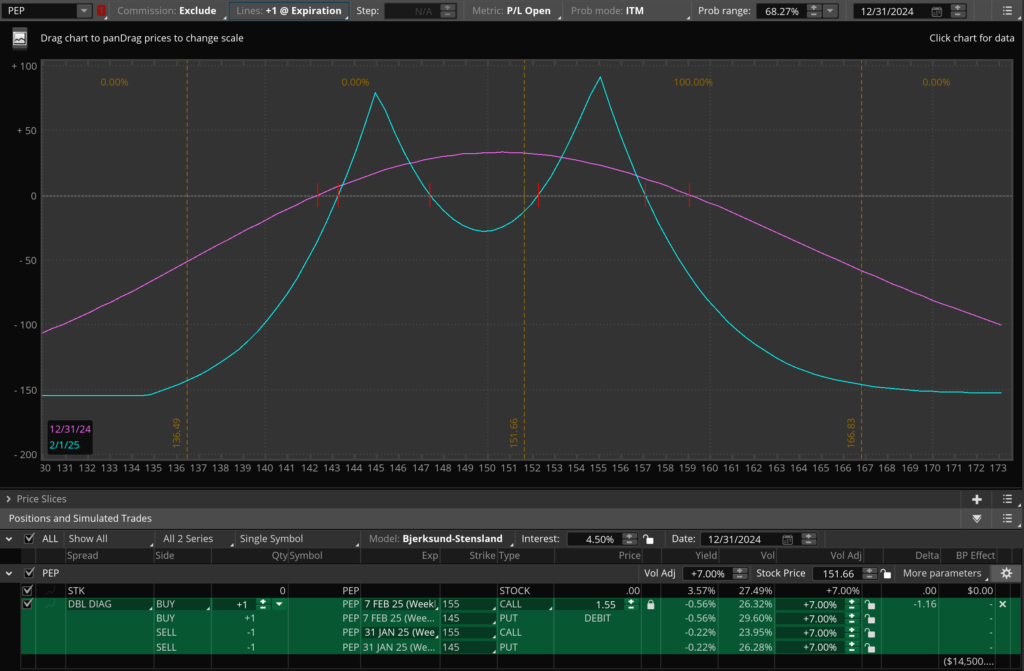

Trade 1. EA Double Eagle

Exit

Total PNL (before transaction cost): -60.8%

Update 1/30: Bought back F5.31 120 C for $0.07, and exercised G5.7 140 P. The 155 call spread is worth $0 so will just let it expire.

Update 1/24: I did get assigned on the short 140 P. Sold F5.31 120 C at $1.05.

Update 1/23: news came out about week Soccer earnings and EA sold off for 18%… The call spread is obviously worthless, and there’s a good chance of assignment on the short put. Still holding on to the whole structure and preparing to sell some covered calls if assigned.

Enter

- Earnings release date: 2/4

- Trade: F5.31/G5.7 140/155 STG SWAP

- ToT stats

- Vol: F5.31 @ 21.5%, G5.7 @ 27%

- Underlying: $146.93

- Premium: $2.5

- DPR: 1.7%

- SPR 10.2%

- Expected IV build: 20%

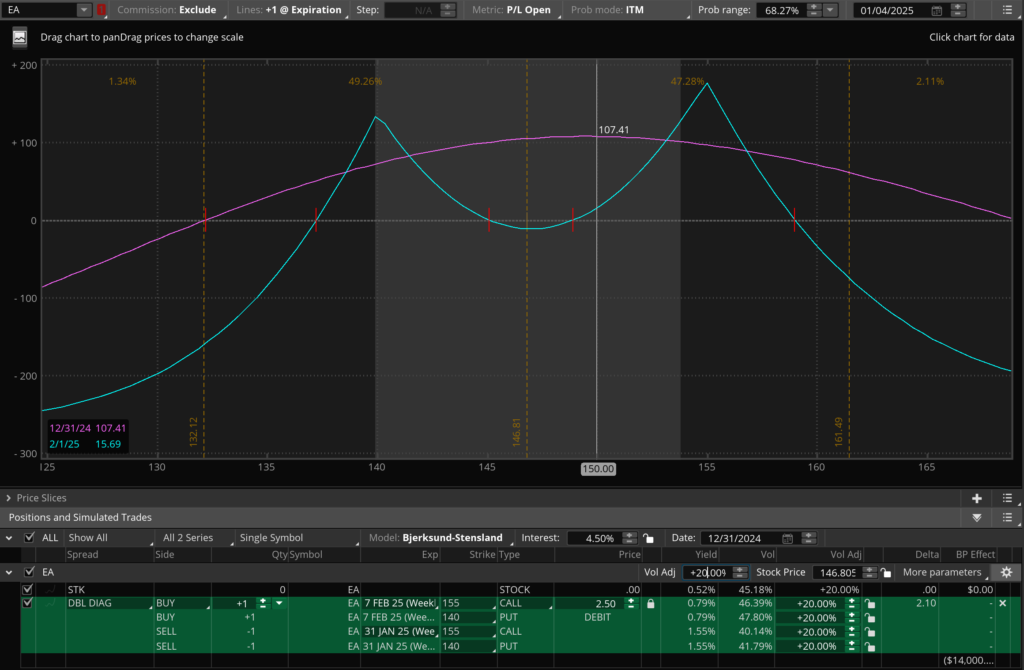

Trade 2. PEP Double Eagle

Exit

Total PNL (before transaction cost): +12.8%

Update 2/3: ER date is Tuesday so had to close the trade. Closed another 2/5 of the positions at $1.68 and the remaining 1/5 at $1.58.

- Close stats

- Vol: G5.7 @ 40.5%

- Underlying: $149.50

Update 1/31: PEP has sold off to the middle range. Let the short strangle expire.

Update 1/28: PEP rallied close to the call strike. Closed 2/5 of the positions at $1.9.

Enter

- Earnings release date: 2/4

- Trade: F5.31/G5.7 145/155 STG SWAP

- ToT stats

- Vol: F5.31 @ 19.5%, G5.7 @ 19.5%

- Underlying: $151.56

- Premium: $1.55

- DPR: 1.02%

- SPR 6.6%

- Expected IV build: 7%